There is more than a passing interest in the 1937 retrenchment or what amounted to a “depression within a depression.” Numerous large-scale similarities abound between what occurred in the middle of the 1930’s and what is shaping up in the middle of the 2010’s. That makes for reasonable study about the very core and basic elements of finance that seem to transcend a great deal of time and financial evolution, but there are also smaller scale resemblances that make the comparison more compelling.

You can start with a simple chronological association of monetary shifting. I reviewed this back in mid and late 2013 but all that has transpired since then may be even more revealing now than just what amounted to possibilities then. The starting point in the mid-1930’s was exactly as it is at this moment, namely that the FOMC believed that the recovery work was done and attention “needed” to rework the monetary policy considerations toward the expected rebirth of “inflation.”

The FOMC meeting in the middle of December 1935 takes on the very same character as May 2013 and the taper talk:

At the December 17-18, 1935, meeting of the FOMC, the governors (then including all the heads of the regional banks, before the board was reconstituted by legislation the next year) voted 7-5 against a measure to increase the reserve requirement on the banking system, a new control lever ceded to the Fed in the new regulatory arrangements of the New Deal age. The measure was voted down not because the FOMC was against ‘tightening’, but because there was no full consensus on the means through which to accomplish it.

In regard to that last factor, the Fed chair introduced a revised resolution that passed 8-4 certifying the board’s stance that monetary inflation was in need of attention, only that the manner of attention was in doubt (some members preferred to use open market operations).

Various policymakers and prominent economists had been making the point about “inflation” for some time before then, with nightmares of the late 1920’s still fresh and relevant (and misunderstood) to the discussion. From the vantage point toward the end of 1935, there was nothing overtly wrong with putting the worst in the past and getting on with ‘normalization”: stock markets had recovered, deflation was nowhere to be found and the business of the American economy was curiously sluggish but at least moving in the “right” direction (including a string of “strong” employment gains).

It was that December 1935 FOMC that marked the official shift in considerations, as noted above the committee actually voted on the subject. From that point forward, all expectations among financial participants was toward a change in the reserve requirements for banks.

The changed in the reserve requirement, which was officially announced in July 1936, was not supposed to significantly alter financial behavior because liquidity was assumed to be more than adequate as a result of “reflation.” Such “tightening” on the part of the banking system, however as a matter of the still-feared liquidity specter haunting from the crash, in response to the policy change was wholly “unexpected.” In that you see the parallel to May 2013 when the financial system altered significantly contrary to what the FOMC intended.

In both the 1930’s case and the current circumstances, policy directives shifted without consideration for the financial discourses. At the end of 1936, the FOMC enacted a second increase in the bank reserve requirement while starting to sterilize gold inflows (actual “tightening”); similarly, at the end of 2013 the current FOMC went ahead with tapering QE.

Initially, interest rates rose across the board after the second of the policy changes before UST rates began to noticeably diverge from credit risk indications (corporate bond spreads, even for investment grade, decompressed from relatively low levels). Just like the current pattern, the entire yield curve steepened and nominally drew upward before falling back and flattening significantly thereafter.

Of course, it wasn’t long before the second recession of the Great Depression formed, and it was a serious interruption that actually conferred the idea of the “Great” in the Great Depression. Never before had economic history seen a collapse take place prior to full cyclical restoration from the previous collapse, and the effects were devastating.

What makes the 1937 case so relevant is the high degree of monetarism embedded within the recovery cycle. The means to which it was accomplished then was far, far different than the operational paths of the four QE’s and ZIRP, but again the major elements are what are persuasive. The dollar defaulted in 1933 as it was devalued which accomplished “inflation” in contrast to the “deflation” of the crash period, which amounted to the same type of wasteful behavior through intrusive interference in price discovery, particularly financial.

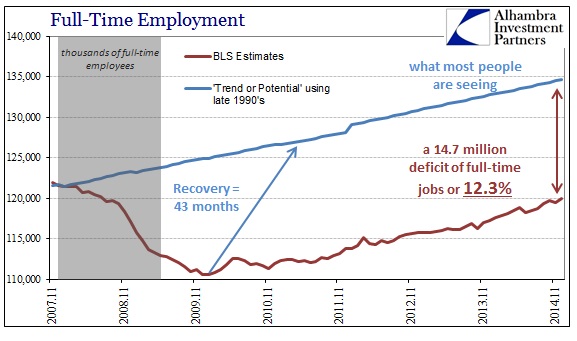

In both the mid-1930’s and the post-crisis 2010’s, the recoveries in each were far more consistent with “reflation” than recovery. The labor market in both periods was gaining, certainly, but not nearly enough to measure an actual and sustainable advance. By the economic peak in 1937, labor participation was dramatically below the 1929 peak even though jobs and payrolls continued to consistently expand throughout. At that peak, the economy was still below “potential” by some 6 million jobs – and so the devastation of the 1937 re-recession was that by 1940 the gap had expanded to nearly 8 million jobs (on a base of only 55 million potential workers). In other words, it wasn’t wages and earned income that was driving the “recovery.”

It is the comparison of the artificial economies across these decades that forces a reckoning of monetary similarities. I have little doubt that the FOMC right now is making the same mistaken assumption as its 1935-37 counterpart – both saw recoveries as entrenched and therefore consistent with true economic growth, so much so that both have gone to great lengths to ignore or dismiss the very obvious deficiencies evident within them.

Economists were shocked at how fragile the US economy actually was in 1937 to react so negatively to essentially a minor shift in policy. The “unexpected” recession that began in May 1937 was likewise asymmetric; very violent that would have ranked among the worst in US history had it occurred in its own right instead of being lumped together with the initial crash period to produce a “lost decade.” Factory employment declined 26% between July 1937 and May 1938 from, as noted above, an already deficient base; industrial production lost 35% of its volume from August 1937 through May 1938.

While we don’t know ultimately how this current episode will eventually work out, the calendar similarities are intriguing to say the least, which is why, given the disparities in methodology and even economic disposition, the parallels may be highlighting basic human and systems interactions that, again, transcend “modernity.” From the first initial indications about “inflation” concerns until actual policy changes were implemented took exactly six months in both cases, with a second intention toward “inflation” coming shortly thereafter. All in all, it was 18 months between the first time the FOMC unleashed “unexpected tightening” and the ultimate onset of serious recession.

On the current end, it was about 18 months between Bernanke speaking about taper and all the glorious negative and bearish credit and funding market action breaking out into the wide open (centered on October 15, 2014).

This is not to say that I expect to see an exact replica of the 1937-38 recession in the next few months; there are just as many differences as similarities in form as well as function. However, again, I think the important point in the study is the reaction of financial and economic systems in the general classification of what amount to serious monetary mistakes drawn from economic mistakes. The lesson of the mid-1930’s really amounts to realizing the negative factors of an artificial recovery, made very apparent by labor and wage deficiencies.

The assumed “stimulus” of monetary interference was just not as potent as believed, as what it conjured amounted to, to a far too high degree, a monetary figment. The recovery wasn’t real and the shift in policy stance rather than complete the normalization instead revealed the precarious insufficiency.

The BIS in 1938 noted this disparity between monetary theory and actual results:

It is human to look backwards at past disasters in the hope of avoiding them in the future. But it might prove as dangerous to be led by fear of a deflation that may not come as it has been dangerous, in some cases, to be led by fear of an inflation that was not imminent. And if fear of deflation be identified with a fear for international monetary stability, this may so hinder economic recovery as to force deflation on a world gorged with gold.

That last part completes the circuit of relevance, as the 1937 re-recession occurred despite a world awash in monetary “stimulus”, “gorged with gold” as the BIS phrased its review. That might be the last and most disheartening thought of the current circumstances as central banks are once again, I believe, mistaking an artificial economic advance for a true recovery (as revealed already in Japan, Europe and China). In pure monetary terms, “money supply” does not dictate financial or economic circumstances as bank behavior and constraints are far more relevant, and ultimately remote, than simple policy penetration.

Credit and funding markets are already ahead of the comparison, seeing a more than ragged end to the experiment. The current age is “gorged” with QE and other forms of monetary intrusions all over the world, but, as was demonstrated in 1937, it won’t matter. Sometimes the pull of economic gravity, the lack of actual economic progress, is just too much to withstand. Monetary officials seem to be in a rush to prove all over again.