Why is the yield curve so steep up at its front? The obvious answer is “rate hikes” and while technically true this leaves out an important set of historical facts. These are that the agency responsible for the rate hikes will, undoubtedly, stick with them regardless of actual conditions on the ground until a forward time when doing so could not be more obviously wrong.

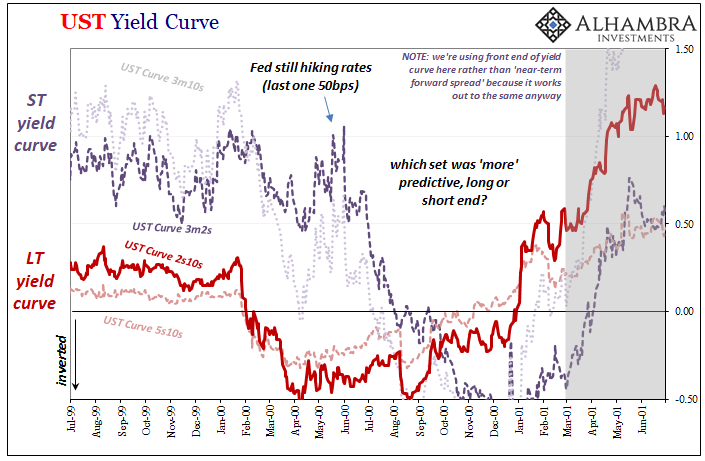

Thus, the yield curve today looks like it did in, for example, the year 2000 just before the dot-com recession.

Image may be NSFW.

Clik here to view.

The Federal Reserve has, in particular among its peers, demonstrated repeated bias toward uninterrupted growth and inflation (except, ironically, that time in the late sixties when it would become the Great Inflation) no matter what happens in the economy. And time and again the institution will either ignore or flat-out reject market signals contrary to its own predetermined forecasts.

More recently, the first, middle, and latter parts of the Great “Recession” 2007-09 demonstrated such blindness, though this problem goes all the way back to the Federal Reserve’s initial roots.

The 1920-21 Depression, a historical mess of blunders. Then the biggest of Big Ones, the Great Collapse. Seventies and early eighties, too.

There is a fundamental problem with the Fed, likely due to nothing more than CYA and human shortcomings – a recession is, right or wrong, attributed in some part to the central bank and the official pushback begins by disdaining any recession risk from its very start.

We’re too good to let something like that happen!

Here’s a more relevant example than you might otherwise think. In 1936, the Fed – in the midst of an uneven “recovery” from the worst of the Great Depression – began to fear runaway inflation (should sound familiar). Devaluing the dollar (FDR gold) had unleashed a torrent of gold onto American shores that was legally obligated to be “returned” the government; as an asset on the Fed’s balance sheet, the offsetting liability was bank reserves.

Image may be NSFW.

Clik here to view.

It was this flood of reserves which caught most worry (should sound familiar). Unsure what to do about it, the debate was whether to use Open Market Operations (selling USTs to the market, something like QT in the modern parlance) or turn to newly established reserve requirement authority.

Officials opted for the latter (though I doubt it would have mattered), banks and markets immediately rejected the premise, then soon the nasty 1937-38 depression-within-a-depression.

By itself, this was on par with some of the worst in the nation’s history. According to the NBER, it began in May of 1937 just two months after the reserve requirement was made effective (banks had already begun adjusting their portfolios late in 1936).

ST bill yields spiked as the banking system liquidated safe, liquid assets banks had actually wanted (and told the Fed they did) if only to increase their own cash cushion once bank reserves were locked up by higher reserve ratios. To put it bluntly, after the experience of the thirties the banking system did not trust the Fed to provide systemic liquidity (this should sound familiar).

Image may be NSFW.

Clik here to view. Image may be NSFW.

Image may be NSFW.

Clik here to view. Image may be NSFW.

Image may be NSFW.

Clik here to view. Image may be NSFW.

Image may be NSFW.

Clik here to view.

Even Milton Friedman’s A Monetary History, a thorough but often charitable review of the central bank than might have been deserved, couldn’t help but rebuke such arrogance and obvious unforced error:

Throughout, the high level of the discount rate relative to market rates reinforced the banks’ reluctance (bred of their 1929-33 experience) to rely on borrowing from the Federal Reserve Banks for liquidity and led them instead to rely on cash reserves in excess of legal requirements and on short-term securities.

Put simply, no matter what had happened during that inflation was never going to; banks didn’t trust the Fed, remained wedded to safe and liquid assets to the point when the Fed took away some of them (bank reserves) by statute, the system quite purposefully retrenched in order to rebuild the prior liquidity cushion.

Even as it meant cutting back lending as well as deposits to accomplish this, thereby turning a recession into what ended up being so bad.

Yet, even as it was happening, those at the Fed remained steadfast in total denial all as it unfolded right in front of them (this sounds increasingly familiar). Rationalizing became rampant. Below from September 1937, the massive depression already several months old, and the FOMC still wasn’t convinced:

Mr. Goldenweiser stated that, while the impetus of recovery had slackened temporarily, there was as yet no evidence of a general decline or recession.

No evidence? The Memorandum’s very next sentence:

In the capital market, Mr. Goldenweiser said, there had been a very definite slackening of activity with less refunding than last year and a scarcity of new issues, and the stock market had gone through a pretty severe reaction recently. In the banking situation, the aggregate amount of investments had gone down and the volume of deposits had decreased but not substantially.

Other than that, how was the play Mrs. Lincoln?

While you might believe this display an inappropriate anecdote given our current situation, an extreme example from long ago ancient times so very unlike the interests facing modernity 2022, the fact that this episode took place at such an extreme is precisely my point. These are the lengths these people will go to if only to stick with their predetermined outlook.

Where are we right now? Right back in the same pit of mistrust; and I mean that in two very important ways. First, like 1937, you think the banking system is just fine with the Fed’s determination of what is, or isn’t, the right amount of systemic liquidity?

This one of the most powerful parallels then to now; having learned the hard way these fools are, well, fools, banks absolutely do not depend on them for when the going gets rough (2007-09, 2011-12, 2014-16, 2018-19, 2020). Thus, safe and liquid all the time.

Second, prospects for downturn blow away those for sustained inflation. Prices were rising rapidly in the mid-30s, too, if coming up then from extreme low levels. Despite such reflation, the general monetary condition (see: above) hadn’t once changed. Always safe and liquid at banks, no lending.

Today, the yield curve is wildly inverted for a couple causes, including the ironclad case of monetary collateral. The other being macro, meaning economic prospects are lining up in all the wrong ways for the near-term.

As predicted, the Fed has responded not by reexamining its assumptions and models, rather with a growing series of denials. The latest from late March (thanks T. Tateo) and already outdated by the speed at which the LT end of the curve has further sunk/inverted.

Inversion spreads again, this time the "big one."

— Jeffrey P. Snider (@JeffSnider_AIP) March 29, 2022

2-year/10-year just crossed intraday. Like before, may not stick into the close but it will over the coming days.

Please explain this one, Mr. Powell.

Even the normally friendly bank Economists are running for cover. pic.twitter.com/Q5dlspL4K1

Right on cue, here come the denials: "Pay no attention to that thing that always makes us look bad because it always ends up being right. This time, THIS TIME, we got it!"

— Jeffrey P. Snider (@JeffSnider_AIP) March 22, 2022

We just did this three years ago. And who could forget 2007 (or '00).https://t.co/pjJw34yf0S pic.twitter.com/OKw0tc3FdH

Image may be NSFW.

Clik here to view.

Its “study” conclusions right in the title (above).

It is not valid to interpret inverted term spreads as independent measures of impending recession. They largely reflect the expectations of market participants. Among various terms spreads to consider, the 2-10 spread offers a particularly muddled view. Especially in the present circumstancs when the 2-10 spread is very much out of step with the near-term forward spread, which offers a much more precise view of market expectations over the next year and a half, it is difficult to concoct a reason to be concerned about the flattening of the 2-10 spread. [emphasis added]

You have to admire how they just say it: “They largely reflect the expectations of market participants.” No kidding; Economists continue to expect Economists are better at this than markets.

What seems most to have motivated this particular update to the authors’ prior study is the 2018 case. Briefly, the pair seems quite worried that the prior 2s10s inversion in August 2019 will somehow be given “credit” for predicting the 2020 recession. They really don’t want that.

I highly doubt that will be the case, at least not by any serious review of that period. On the contrary, and also contrary to the study, the yield curve case had already been made the year before whether or not the US (and global) economy might have ended up in recession in 2020 (if not already in 2019) COVID or no COVID (and, as the authors admit, we’ll never know).

During the first quarter of 2019, concern grew regarding the decelerating economy. For instance, the minutes from the March 2019 FOMC meeting stated, “… growth of economic activity had slowed from its solid rate in the fourth quarter… Participants cited various factors as likely to contribute to the step-down, including slower foreign growth and waning effects of fiscal stimulus.” Unsurprisingly, market participants began to expect that more accommodative monetary policy could be in the offing. Such expectations, which caused the near-term forward spread to decline and eventually turn negative, were subsequently ratified in July 2019, when the FOMC lowered the target range for the federal funds rate.

No sir, this is pure gaslighting. Economic concerns had been expressed long before the first or middle quarters of 2019. As we know, the whole matter of interpretation is never left strictly to the Treasury curve’s one part or the other. Eurodollar futures, interest rates swaps, etc., etc. The curve for eurodollar futures had inverted all the way back in June 2018 – when the “near-term forward spread” was telling us nothing of particular use.

Instead, while the Federal Reserve remained steadfastly if not more solidly committed to rate hikes and the inflation fears driving them into 2019, these markets together had warned not to believe it long before the events of that year would play out just as they would.

The 7s10s near-inversion back during the middle of 2018 far more instructive and useful because it was corroborated by, “They largely reflect the expectations of market participants” among the deepest, largest, and most sophisticated of them who, unlike the Fed, are actually responsible for money and economy.

Finally, the current divergence between the near-term spread and longer-term yield curve inversions is not, actually, unusual. For one example, another one when the Fed was chasing inflation ghosts that didn’t exist even though the economy was already on its way toward recession, as I already mentioned the 3m10s spread steepened out in late ’99 and remained that way quite a long way into 2000 despite more predictive longer run inversions having shown up earlier in the year.

Same thing, you’ll note, in the late 1980’s just prior to the 1990-91 recession – I’ve circled both on the chart I’ve pulled from this “study” so you can see the evidence it provides doesn’t really match its conclusions.

Image may be NSFW.

Clik here to view.

Image may be NSFW.

Clik here to view.

Some things never change; the Fed, by every historical account, appears incapable. It will express confidence on the economy to the point of favoring an inflationary bias for very simple reasons: an inflationary bias indicates enough if not too much money which is the same as saying the Fed has at best done its job and at worst too well.

This the same as 1937, when, convinced inflation was the greater risk, that same if older Fed held onto reserve requirements for over a year until early 1938 when the economy had already been devastated and it could longer justify “the impetus of recovery had slackened temporarily” by any even increasingly ridiculous rationalizing.

Just as markets had forewarned (though no inversion back then).

The reason for how the front end of the yield curve today, like times past, presents itself is that the Fed has shown over and over how it can and does remain steadfastly committed to its own errors in judgement and bias. In 2022, that could (likely?) translate into a situation where Jay Powell just keeps on hiking though a recession has already begun and strengthened.